In a world where money moves fast and financial goals keep growing more complex, budgeting and financial planning have never been more essential. Thankfully, the rise of smart apps — especially those powered by automation and artificial intelligence — has transformed personal finance from spreadsheets and stress into something intuitive, accessible, and even empowering.

Today’s top budgeting and finance apps do more than just track your dollars and cents. They automate bill payments, categorize transactions automatically, forecast spending habits, help you save without thinking about it, and even guide you toward long‑term financial goals. Whether you’re managing everyday expenses, planning for retirement, or saving for a big purchase, these apps make it easier to stay on track with less effort.

Let’s break down the top budgeting and finance apps with smart automation that are worth considering in 2026 — and how each can help you take control of your money.

💡 What Smart Finance Automation Means

Before we dive into specific apps, it’s helpful to clarify what we mean by automation in budgeting and finance tools:

- Automatic transaction categorization: The app analyzes your bank or card activity and assigns categories like “Groceries,” “Entertainment,” or “Bills” without you lifting a finger.

- Smart alerts and reminders: Get notified when bills are due, when a subscription renews, or when you’re approaching a spending limit.

- Automated savings: Some apps automatically move small amounts into savings based on rules you set — or based on patterns they detect in your spending.

- Spending forecasts: Predict where your money will go based on past behavior, helping you avoid surprises.

- Goal automation: Set saving or debt‑payoff goals and let the app suggest or automatically execute steps to reach them.

Now let’s explore the best apps that bring these features to life.

📊 1. All‑In‑One Budgeting Apps

These apps serve as a central finance hub, merging tracking, planning, forecasting, and automation.

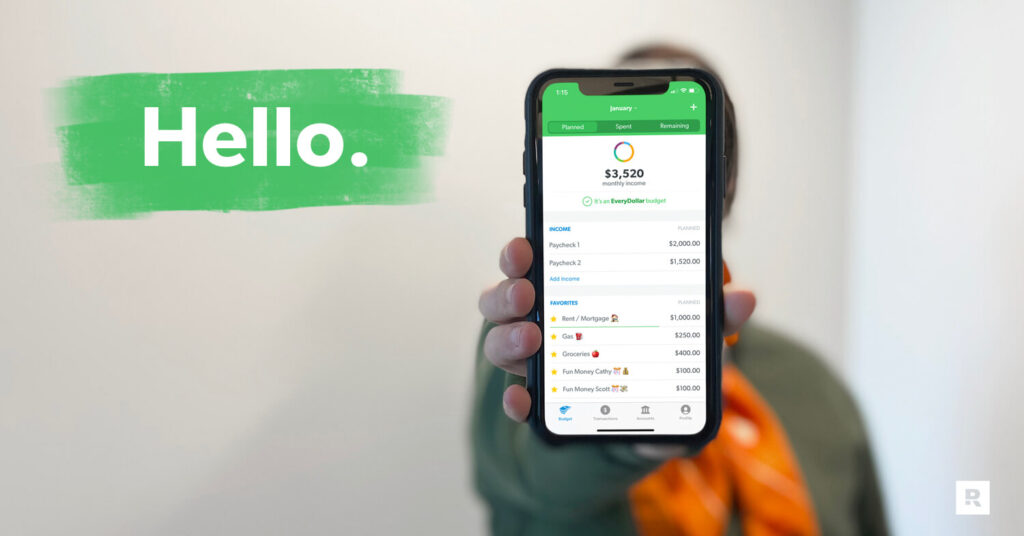

Example: Everyday Budget Manager

Imagine an app that connects to all your bank accounts, credit cards, and loans. It categorizes every transaction automatically — groceries, utilities, subscriptions — then builds a personalized monthly budget based on your habits.

It also:

- Alerts you when you’re close to overspending in a category

- Automatically suggests ways to trim expenses

- Forecasts how your cash flow will look next month

- Helps you set goals like “Save $500 for vacation” or “Pay off credit card by December”

For a busy professional, this means no more manual entry and no guesswork about where your money went.

📅 2. Automated Savings Apps

Some apps focus specifically on helping you save — using automation that feels effortless.

Example: Smart Saver

This app links to your checking account and watches for spending patterns. When it detects that you’re under your usual spending threshold, it automatically transfers a small amount to your savings or investment account.

Features often include:

- Round‑ups: Every purchase is rounded up to the nearest dollar, and the spare change gets saved.

- Rules‑based transfers: You might set a rule like “Save $20 when my balance is above $2,000” — and the app follows it automatically.

- Goal suggestions: If you’re saving for a specific purpose (emergency fund, new laptop, travel), the app helps you set a target and tracks your progress.

What makes this appealing is its passive nature — you save without actively thinking about it.

📉 3. Expense Tracking and Categorization Tools

These apps focus on keeping you aware of how you’re spending and where your money is going — with automation doing most of the heavy lifting.

Example: Insight Tracker

Once connected to your accounts, Insight Tracker:

- Automatically tags transactions into categories

- Shows trends over time (e.g., eating out vs grocery spending)

- Sends insights like “You spent 20% more on subscriptions this month”

It may also allow you to set monthly limits on categories — and alert you when you’re approaching them. For example, if you’ve budgeted $150 for entertainment, the app might alert you when you hit $120 so you can adjust your spending.

This kind of automation helps you make better decisions all month long.

📈 4. Forecasting and Cash Flow Tools

Rather than just tracking history, some apps try to predict your financial future — and help you prepare.

Example: Forecast Finance

This type of app looks at your income patterns, bills, recurring subscriptions, and spending behavior to:

- Predict your cash flow for the next 30 days

- Warn you about potential shortfalls before they happen

- Suggest when to transfer money into savings or move funds between accounts

For freelancers or people with variable income, knowing when lean weeks may arrive can be invaluable.

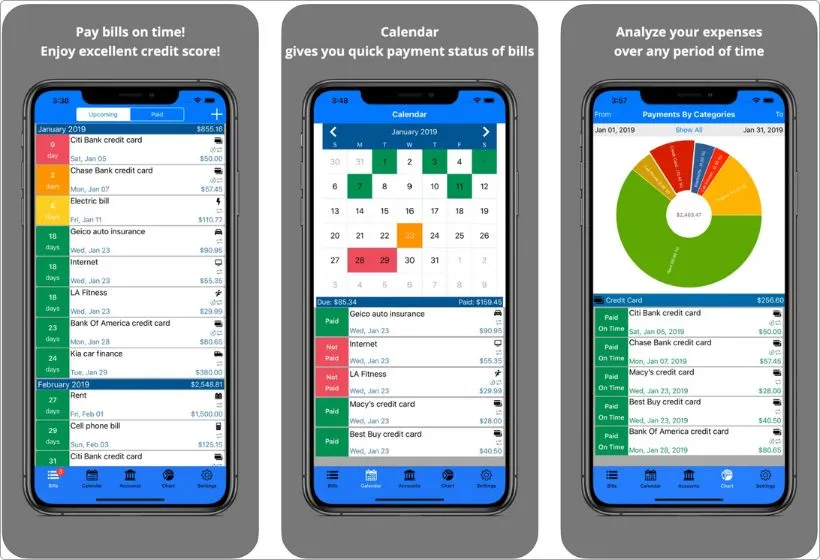

🧾 5. Bill Management and Payment Automation

Scheduling and paying bills on time can save money (late fees!) and stress.

Example: Bill Commander

This app can sync with your calendar and banking profile so it:

- Recognizes recurring bills (rent, utilities, subscriptions)

- Sends reminders before due dates

- Automatically pays bills if you choose

- Tracks due dates in a dashboard

This removes a lot of manual work and helps protect you from penalties — while keeping your credit profile in good shape.

📌 6. Debt Tracking and Paydown Planners

Paying off debt efficiently isn’t just about throwing money at it — it involves strategy.

Example: Debt Navigator

Debt Navigator connects to your loan accounts and helps you build a paydown strategy. Using automation, it may:

- Suggest prioritizing high‑interest debts

- Calculate extra payments you can afford

- Recalculate payoff timelines as your finances change

- Automatically recommend ways to free up funds for debt repayment

This shifts debt management from feeling overwhelming to manageable and focused.

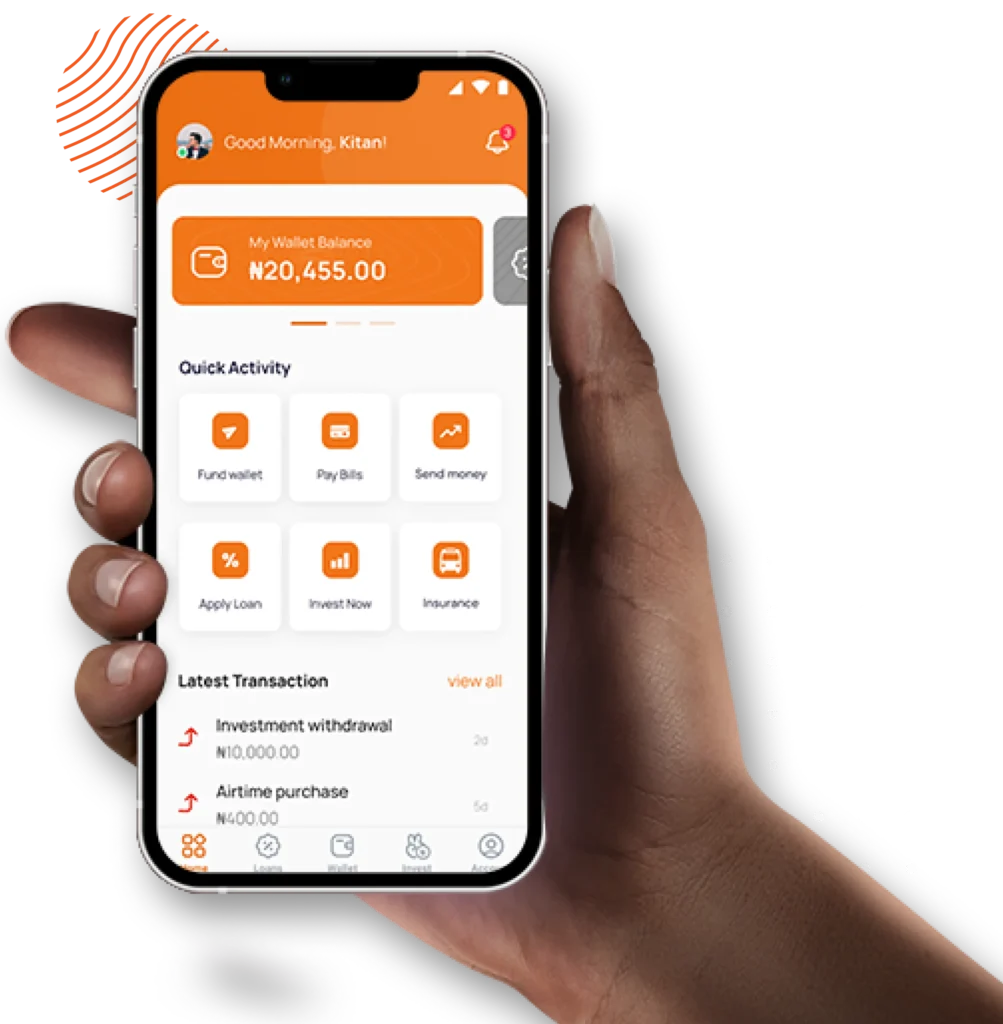

📊 7. Investment and Portfolio Helpers

Some finance apps combine budgeting with investment tracking and insights.

Example: Investment Insights App

These apps connect to your brokerage accounts and show your portfolio performance alongside your budget. Automated features may include:

- Alerts for portfolio rebalancing opportunities

- Suggestions for diversification

- Forecasted growth based on historical performance

Instead of treating budgeting and investing as separate realms, these apps unify your financial picture.

🧠 What to Look for in a Smart Finance App

Here are some tips to choose the best app for your needs:

🔗 Seamless Account Integration

Choose apps that connect securely with your bank, credit cards, loans, and investments so they can automate everything without manual entry.

🔐 Security and Privacy

Make sure the app uses strong encryption and gives you control over data sharing.

📊 Customizable Automation

Automation is great — but you should be able to tailor how the app categorizes transactions, transfers savings, or sends alerts.

💡 Clear Visual Insights

Look for apps that turn your financial data into easy‑to‑understand charts and trends so you can actually act on information.

🧩 Goal Support

Whether your focus is saving, paying off debt, or investing, choose tools that align with your priorities and help you move toward them.

💬 Real‑World Example Scenarios

📍 Scenario 1: The Busy Professional

Sarah has a full schedule and often forgets bills. Using an all‑in‑one budgeting app plus a bill automation tool, she gets reminders before due dates and sets automatic savings transfers when her balance is healthy. She now saves for vacations effortlessly and rarely misses a payment.

📍 Scenario 2: The Freelancer

James has variable income. A forecasting app predicts his cash flow for the month and alerts him if he might run short before his next paycheck, helping him adjust spending and avoid overdraft fees.

📍 Scenario 3: The Goal‑Oriented Saver

Maria wants to buy a home in a year. She sets a savings target in an automated savings app that rounds up transactions and contributes the spare change. Over time, those small transfers add up faster than she expected.

Final Thoughts

Smart budgeting and finance apps are transforming how people manage money. Automation removes repetitive tasks, reduces guesswork, and helps you make confident decisions — whether you’re tracking expenses, saving for milestones, paying off debt, or planning for the future.

The key is choosing tools that fit your life, personalize automation to your habits, and give you clarity instead of complexity. With the right apps, your finances can become less of a burden and more of a roadmap to your goals.